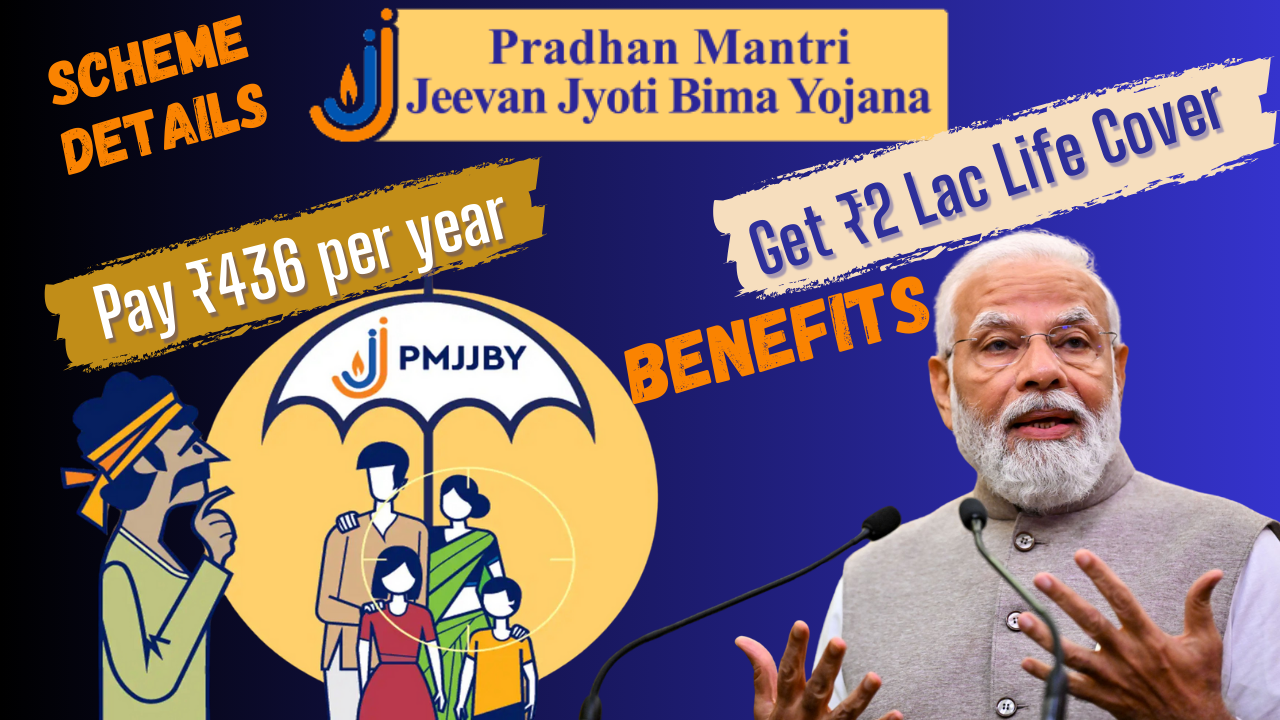

In today’s world, securing your family’s financial future is of utmost importance. The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a government-backed term insurance scheme designed to provide life cover at an affordable premium. This initiative aims to ensure financial stability for families in case of the unfortunate demise of the earning member.

In this blog, we will discuss the benefits, eligibility criteria, enrollment process, and claim procedure of PMJJBY.

What is Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

The Pradhan Mantri Jeevan Jyoti Bima Yojana was launched by the Government of India in 2015-16 as part of its social security initiatives. It provides life insurance coverage of ₹2 lakh to the insured individual in case of death due to any reason.

This scheme is renewable every year and is offered through banks and post offices, in collaboration with insurance companies.

Features & Benefits of PMJJBY

✔ Affordable Premium – Pay only ₹436 per year for ₹2 lakh life cover.

✔ Available for All Citizens – Open to all Indian residents and NRIs with a bank account.

✔ Easy Auto-Debit – Premium is automatically debited from the subscriber’s bank or post office account.

✔ One-Year Renewable Cover – Policy coverage is from June 1st to May 31st every year.

✔ Coverage Against All Causes of Death – Financial protection is provided regardless of the cause of death.

✔ Quick Claim Settlement – Nominees receive the insurance amount upon submission of necessary documents.

Eligibility Criteria for PMJJBY

To enroll in this scheme, individuals must meet the following conditions:

🔹 Age should be between 18 to 50 years.

🔹 Must have a savings bank account or post office account.

🔹 Should give consent for auto-debit of the premium.

🔹 NRIs can apply, but claim benefits will be paid in Indian currency.

🔹 Only one policy per person is allowed, even if multiple accounts exist.

How to Apply for PMJJBY?

You can easily enroll in PMJJBY by following these steps:

1️⃣ Visit your bank branch or post office where you hold an account.

2️⃣ Fill out the PMJJBY application form and submit it.

3️⃣ Provide nominee details to ensure a smooth claim process.

4️⃣ Give consent for auto-debit of the premium from your account.

5️⃣ Your policy will be activated, and life cover will start from June 1st (or the enrollment date, if later).

Claim Process for PMJJBY

In case of the insured person’s death, the nominee/legal heir must follow these steps to claim the insurance:

🔹 Submit a claim form at the respective bank or post office branch.

🔹 Provide death certificate as proof of demise.

🔹 Submit KYC documents of the insured and nominee.

🔹 If death was due to an accident, submit an FIR and post-mortem report.

🔹 The claim will be verified, and if all documents are correct, the insurance company will transfer ₹2 lakh to the nominee’s bank account.

🕑 Claim settlement is usually processed within a few weeks.

PMJJBY Enrollment Period & Premium Details

The coverage period for PMJJBY is from June 1st to May 31st every year. If you enroll late, the premium is charged on a pro-rata basis:

📅 June – August → ₹436/-

📅 September – November → ₹342/-

📅 December – February → ₹228/-

📅 March – May → ₹114/-

🚨 If the policy is not renewed before May 31st, it will lapse, and coverage will stop until renewal.

Termination of PMJJBY Coverage

The insurance cover ceases in the following cases:

❌ The insured person attains 55 years of age.

❌ Closure of bank/post office account or insufficient balance for premium payment.

❌ If an individual is found to be enrolled in multiple banks, only one policy will be valid.

❌ If the policy lapses due to non-payment, it can be reinstated, but the 30-day lien period will apply again.

Conclusion!

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is an excellent low-cost life insurance plan designed for financial protection. With its simple enrollment process, affordable premium, and government backing, it is a must-have for individuals looking for basic life insurance coverage.

If you haven’t enrolled yet, visit your bank or post office today and secure your family’s future!

💬 Have questions about PMJJBY? Drop them in the comments!

👉 If you found this blog helpful, do check out my YouTube video on PMSBY here:

📢 Share this post with your family & friends to spread awareness. ✅