Introduction

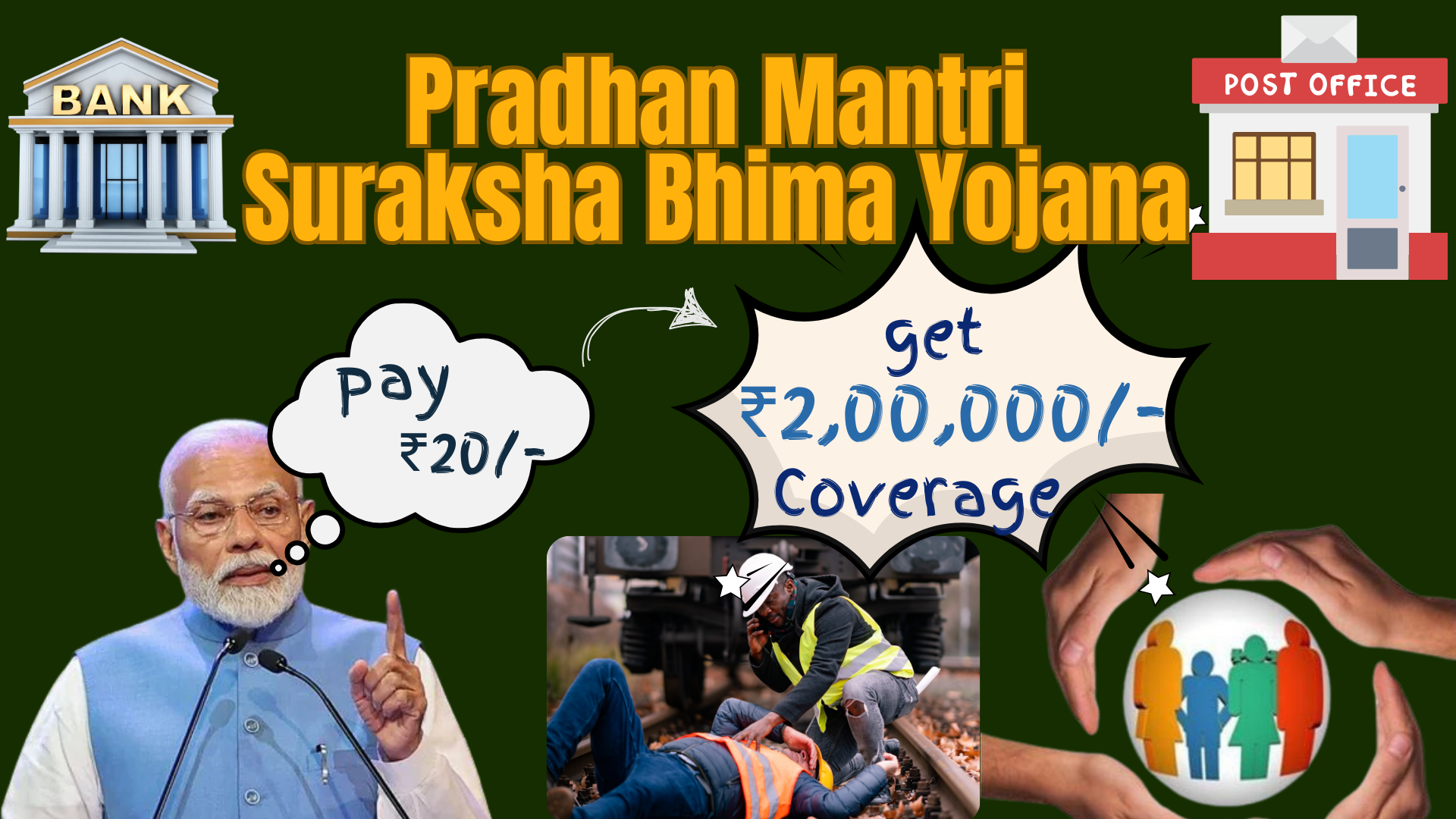

Financial security is crucial, but many people avoid insurance due to high premiums. To make insurance affordable for all, the Government of India launched Pradhan Mantri Suraksha Bima Yojana (PMSBY) in 2015.

In this post, you’ll learn everything about PMSBY scheme details —benefits, eligibility, coverage, and how to apply!

What is Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

- PMSBY is a government-backed accidental insurance scheme in India.

- It offers ₹2 lakh coverage in case of accidental death or permanent disability.

- The premium is just ₹20 per year, making it one of the cheapest term Insurance Scheme in India.

Who Can Apply for PMSBY?

- Any Indian citizen aged 18 to 70 years.

- Must have a savings bank account in a bank or post office.

- The policy is valid for one year and needs to be renewed annually.

- One person can enroll only through one bank or post office account.

PMSBY Insurance Coverage & Benefits

🛡️ Accidental Death: ₹2 lakh paid to nominee.

🛡️ Permanent Total Disability (loss of both eyes, hands, or feet): ₹2 lakh.

🛡️ Partial Disability (loss of one eye, hand, or foot): ₹1 lakh.

PMSBY Premium & Payment Process

- The premium is just ₹20 per year.

- It is auto-debited from your bank account every year before June 1st.

- If the premium is not debited due to insufficient balance, coverage will stop until reactivation.

How to Apply for Pradhan Mantri Suraksha Bima Yojana?

📌 You can enroll in PMSBY through:

✔️ Your bank branch (SBI, Canara Bank, PNB, HDFC, etc.)

✔️ Post offices offering the scheme

✔️ Online banking apps of your bank

✔️ Internet banking or mobile banking

👉 Simply submit the PMSBY enrollment form and enable auto-debit.

How to Claim PMSBY Insurance?

In case of an accident, the nominee or legal heir must:

1️⃣ Submit a PMSBY claim form at the bank/post office.

2️⃣ Provide death certificate or medical reports proving disability.

3️⃣ Submit FIR, Post-mortem report (in case of accidental death).

4️⃣ Provide nominee’s KYC documents & bank details.

5️⃣ Once verified, the insurance company credits the claim amount.

When is PMSBY Coverage Terminated?

❌ If the insured person turns 70 years old.

❌ If the bank account is closed or insufficient balance for premium.

❌ If the person is covered under multiple accounts, only one will be valid.

Is PMSBY Worth It?

Yes! For just ₹20 per year, you get ₹2 lakh accidental coverage under a government accident insurance scheme in India. Best for low-income families, daily wage workers, and self-employed individuals. A great backup plan to ensure financial security for your family.

Conclusion

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a must-have insurance policy for every Indian. It provides huge coverage at a minimal cost, making it the best accidental insurance plan available today!

👉 If you found this blog helpful, do check out my YouTube video on PMSBY here:

📢 Don’t forget to share this with your friends & family so they can benefit too!